Once you have a registered startup, the first thing to do is look for is Startup funding. While many founders have amazing startup ideas, it can be hard to get funding from VC firms instantly. The primary source of funding there startup for anyone is either their own money or loans taken from their friends and family.

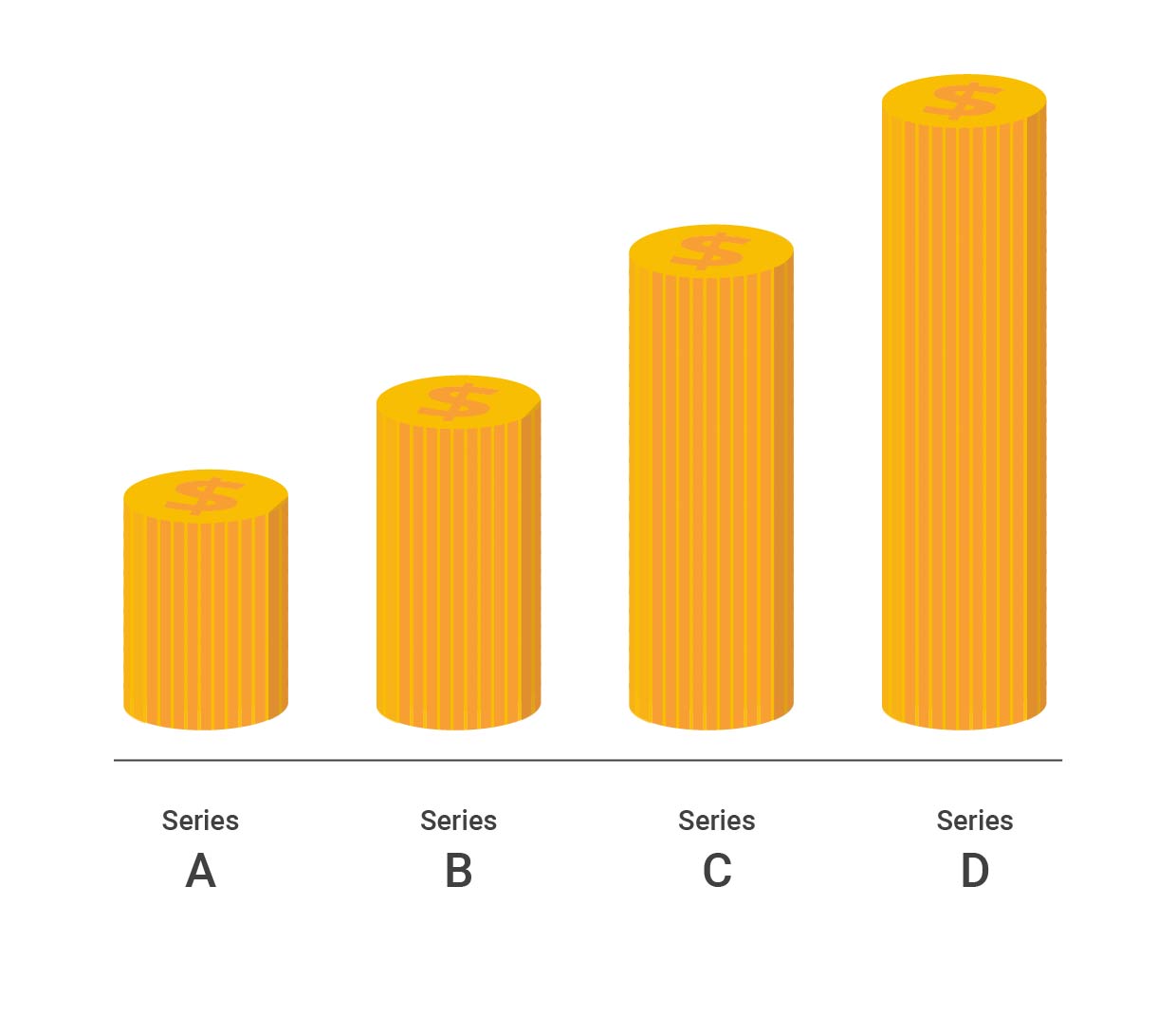

Shortly after starting off and building your prototype, you’re going to need more money. Where will you find it? This is when you start looking for funding. There are multiple stages of funding that every startup goes through. I’m going to tell you about four of these – angel investors, seed funding, venture capitals, and private equites for funding your startup.

What are Angel Investors?

Long story short, an angel investor is typically an individual with a lot of money who wants to invest in your business in exchange for equity.

In detail, angel investors are wealthy individuals looking to invest in early-stage startups that have a strong base or idea in exchange for a share of the equity. These investors look for a working prototype or a defined model in place, a strategically prepared business plan, the founder’s dedication towards the company, to name a few things.

Angel investors usually only fill in the gap between self-funding and raising a round of series fundings. The amount invested by angel investors can be anywhere between only a few thousand dollars to a couple of million dollars. As these are individuals investing their own money, be prepared to answer a series of questions that hit very close to home. Raising funds from private investors is just as hard as raising funds from a venture capital firm. Companies showing a great potential for growth are ideal for angel investments. This potential can be measured via the willingness of people to pay for your product/services. A business that seems to be generating some sort of revenue is more likely to raise funding and a higher amount of funding for that matter. Angel investors are also interested in investing in startups with brilliant ideas and great team members.

For a list of angel investors, visit here.

What is Seed Funding?

Seed funding is the earliest form of funding received by a startup. When a startup is looking for initial funding, the primary source of seed funding is personal investments by the founder. His/her family and friends, or angel investors. During this stage of funding, founders are usually still building the prototype of their model. There’s no actual source of income or profits, so companies survive on the seed capital only.

The amount invested at this stage is still very low as compared to others as this is only the basic capital needed to start your business. Investors expect a share of the equity in exchange for their investments. Usually, these funds are only used for market research and is useful till a startup finds venture capitals to invest in their business.

Venture Capital

What is Series A funding?

Series A funding is where a venture capital first gets involved. The funding raised in this series could be any single digit million dollar amount and there’s a slight chance it could go up to 15 million dollars. Being a venture capital firm that’s dedicated to investing in profitable companies with a growing customer base, the amount of funding raised is generally a lot higher as compared to that by an angel investor.

This stage of funding is where the first preferred stock is offered to external investors. The aim of raising Series A funding, apart from expanding your business, is also paying the salaries of all current employees. This opportunity can be used to dip your toes into different markets and expand. A crucial stage, this round of funding should be utilized in building a plan for long-term profit generation.

What is Series B funding?

After having utilized the previous round of funding in building a business plan for long-term profit and having your product available in the market for sale, it’s time for another round of funding. Series B funding is where businesses have access to a much greater amount of funding as compared to the previous funding. At this stage, it’s time to stop generating a decent amount of revenue and time to start making serious profits. Since the product is already out there and a business plan is in place, reaching this stage of funding means the risk of investment is lesser.

With series B funding, companies can expand their employee base and build a stronger team so as to expand in different markets and take the business to another level. Although the risk of investment is lower, the amount is higher. And this is why at this stage, companies are put to the test; reports are analyzed, businesses are dissected to reveal any sort of flaw in the plans or chances of a downfall.

What is Series C funding?

During series C funding, investors are more interested in companies that are already successful in business. Companies go for this round of funding when they’re looking to expand to other markets or preparing for acquisitions. This is usually the stage after which companies have their first Initial Public Offering (IPO).

Amounts raised in series C funding stage could go up to hundreds of millions.

What is Series D funding?

If a company decides to not go public and stay private for a longer time, they opt for series D. A company reaching this stage of funding could have three scenarios –

– They’re holding on by a thread

– They’re doing extremely well in business

– They’ve chosen to stay private till they’re in a better condition for an IPO

Companies these days choose to go for rounds of fundings with smaller amounts instead of one big investment.

A list of the top 50+ venture capital firms is available here.

Private Equity

Private equity investments are made in companies that have not gone public yet. P.E firms invest huge sums of money with the aim of acquiring a good position with control in the company. Firms get their return on investments commonly when these companies have their Initial Public Offering. They also get their returns via mergers with other companies or when the company is acquired by another company.

If you want to expand your team and are looking to hire, give us a call at +91 87674 27427 or drop us an email at buzz {@] sutrahr.com anytime and we’ll get back to you!

OR

If you want to work at an amazing startup, send us your resume at hiring {@] sutrahr.com or give us a call at +91 77188 73526 now.

Disclaimer: This is a generalized list. This list is based on the most common types of funding that startups receive. There will also be certain exceptions to the rule and a few might skip certain stages. For eg. These days we’ve also seen many pre-series A funded startups coming up.

In case you know any new patterns in startup funding, please let us know in the comment section below 🙂